23rd of January, 2017

New Draft Law On Gas Market Downstream & Midstream Activities

Keywords: Oil & Gas and Mineral Resources

The draft gives private parties access to the gas infrastructure and provides details of a new licensing regime.

Despite the great gas discovery back in August 2015 (see here), the gas market still suffers; as Egypt’s gas production does not meet market needs (see here). As an attempt to overcome this inefficiency and reform the gas sector, the government chose to embark on a gradual gas market liberalization scheme, in conformity with international practice. After two years of working on a new gas transmission system with technical assistance from the EU, in December the government submitted to parliament its revised draft law regarding the regulation of the downstream and midstream sectors. The Draft Gas Market Activities Regulation Law (the “Draft Gas Law”) is another step by the government in the right direction for policy reform. The new regime will hopefully improve the investment environment both in the oil & gas sector, as well as in industrial and export sectors reliant on gas.

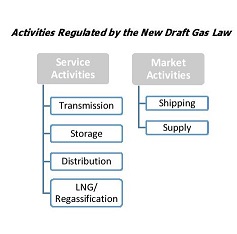

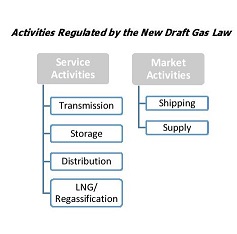

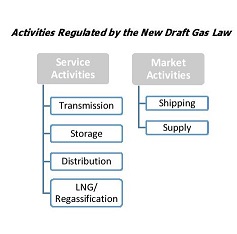

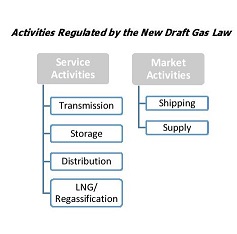

The Draft Gas Law does not address the gas upstream sector or oil concession agreements. The legal framework of upstream activities is still intact. The Draft Gas Law regulates transmission, distribution, storage, liquefaction, regasification, shipping and supply of gas (the “Gas Market Activities”). The Draft Gas Law is an attempt to gradually liberalize the gas market. It allows the private sector for the first time to engage in Gas Market Activities.

agreements. The legal framework of upstream activities is still intact. The Draft Gas Law regulates transmission, distribution, storage, liquefaction, regasification, shipping and supply of gas (the “Gas Market Activities”). The Draft Gas Law is an attempt to gradually liberalize the gas market. It allows the private sector for the first time to engage in Gas Market Activities.

The Draft Gas Law Establishes A New Gas Market Regulator:

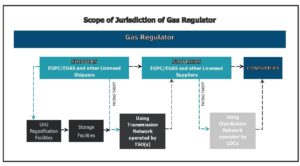

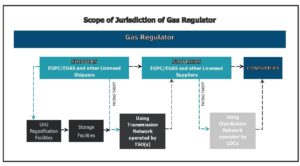

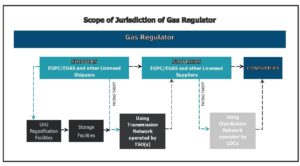

- The Draft Gas Law establishes the Authority for Regulating the Activities of the Gas Market (the “Gas Regulator”). The Gas Regulator shall be an independent public entity affiliated to the Ministry of Petroleum. The Gas Regulator’s main objective will be regulating and controlling the gas market downstream and midstream activities; securing the supply of gas to meet domestic market needs; and setting a plan to attract and encourage gas market investments.

- The Gas Regulator will be responsible for:

- Granting licenses to gas market parties.

- Ensuring competitiveness and transparency between the gas market parties.

- Setting tariff methodologies for the use of gas transfer/distribution grids.

- Settling the disputes that may arise between the parties involved in gas market activities.

The Market Structure After The New Regime

Third Party Access:

- The new law introduces to the Egyptian gas market “Third Party Access (TPA)” policies. According to TPA, and for the first time, the private sector will have access to the gas transmission and distribution infrastructure owned and currently operated by government players, such as EGPC and EGAS. This will open the gas market for a competitive environment and help with the launching of the market liberalization strategy.

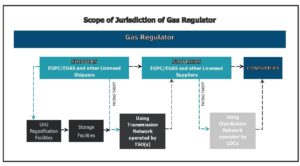

- The Gas Regulator can license one or more Transmission System Operator(s) (TSO) to operate the transmission grid and several local distribution companies (LDCs) to operate the distribution network. Shippers will contract with the TSO(s) to transmit their gas through the TSO’s grid to Suppliers. TSOs and Shippers will be bound by the Transmission Network Code (TNC) issued by the Gas Regulator regulating the specifications and conditions of transmission and the Transmission Tariff, also issued by the Gas Regulator to set prices.

- Shippers will typically sell/handover the gas to Suppliers who will contract with LDCs to use their distribution grids to reach consumers and export pipelines. Both Suppliers and LDCs will be bound by the Distribution Code and Distribution Tariff set by the Gas Regulator.

- Licensed operators of the gas storage facilities, LNG facilities, and regasification facilities shall also collect charges (a tariff set by the Gas Regulator) from the Shipper in consideration of their services.

- It is worth mentioning that the Draft Gas Law is not very clear as to how discrimination in access to transmission and distribution grids will be prevented or how competition between the parties will be protected. The Draft Law states that this will be further clarified in the executive regulation (ER) or the TNC.

Eligible and Non-Eligible Consumers:

- Similar to the new electricity regime, the Draft Gas Law differentiates between Eligible Consumers and Non-Eligible Consumers. Only Eligible Consumers will have the freedom to enter into gas supply agreements with suppliers of their choice and with freely negotiated price and gas quantities. This will take place through a competitive market set-up that will be established after the law enters into force. The Draft Gas Law provides that Eligible consumers may switch from one supplier to another; however, it does not provide any conditions on limitations on how this works. We anticipate this will be addressed in the ER or the rules governing the competitive market.

- Non-Eligible Consumers may not choose their gas suppliers and shall pay the fixed price set by the government for the amount of gas supplied to them.

Licensing Regime:

- Any entity shall obtain a license from the Gas Regulator before engaging in any of the Gas Market Activities. The duration of the license shall be determined in the ER (expected to be for a term of 5 years renewable, according to the draft Shipper’s/Supplier’s licenses being discussed).

- Each activity referred to above requires a different license. The two activities of shipping and supply may be carried jointly by one entity after being licensed by the Gas Regulator to do both.

- The Draft Gas Law allows a “Multi-Activity Entity” to combine different service activities (transfer, distribution, storage, liquefaction and regasification) with market activities namely shipping or supply, provided that it establishes a separate legal vehicle with independent organizational structures for each type of activity. There is some confusion in the drafting of Article 44 regulating the obligations of Multi-Activity Entities, which we hope will be clarified before the Draft Gas Law is issued. The Draft Gas Law gives a five-year grace period to existing bodies to abide by the rules on separation of activities.

- For an entity to receive a license in any of the Gas Market Activities, it has to:

- Pay a fee (maximum of USD 0.1 per cubic meter, paid in EGP).

- Pay an insurance to prove seriousness (the amount of the insurance shall be determined in the ER).

- Provide documents to prove technical and financial capability.

- Any licensed entity will need to obtain the Gas Regulator’s approval to:

- Assign its license to another entity.

- Sub-contract any entity to perform the license activity on its behalf.

- Conduct any change to the title of its shares whether through sale, purchase or transfer of shares, capital or assets.

- Take any action that would result in a change of control in relation to the capital of the licensed entity.

What Happens To EGAS And EGPC?

- EGAS and EGPC are currently the only entities involved in the gas transmission (shipping). Therefore, after the Draft Gas Law enters into force, the old dynamics will certainly change, since there other parties will become involved. EGAS and EGPC will continue to ship gas along with other licensed parties. EGAS and EGPC will contract with TSOs and be committed to the obligations regarding the supplying, shipping and using the grids. EGAS and EGPC will also be bound by the tariff determined by the Gas Regulator and shall preserve transparency. (see here)

The Draft Gas Law does not address the gas upstream sector or oil concession agreements. The legal framework of upstream activities is still intact. The Draft Gas Law regulates transmission, distribution, storage, liquefaction, regasification, shipping and supply of gas (the “Gas Market Activities”). The Draft Gas Law is an attempt to gradually liberalize the gas market. It allows the private sector for the first time to engage in Gas Market Activities.

agreements. The legal framework of upstream activities is still intact. The Draft Gas Law regulates transmission, distribution, storage, liquefaction, regasification, shipping and supply of gas (the “Gas Market Activities”). The Draft Gas Law is an attempt to gradually liberalize the gas market. It allows the private sector for the first time to engage in Gas Market Activities.

The Draft Gas Law Establishes A New Gas Market Regulator:

- The Draft Gas Law establishes the Authority for Regulating the Activities of the Gas Market (the “Gas Regulator”). The Gas Regulator shall be an independent public entity affiliated to the Ministry of Petroleum. The Gas Regulator’s main objective will be regulating and controlling the gas market downstream and midstream activities; securing the supply of gas to meet domestic market needs; and setting a plan to attract and encourage gas market investments.

- The Gas Regulator will be responsible for:

- Granting licenses to gas market parties.

- Ensuring competitiveness and transparency between the gas market parties.

- Setting tariff methodologies for the use of gas transfer/distribution grids.

- Settling the disputes that may arise between the parties involved in gas market activities.

The Market Structure After The New Regime

Third Party Access:

- The new law introduces to the Egyptian gas market “Third Party Access (TPA)” policies. According to TPA, and for the first time, the private sector will have access to the gas transmission and distribution infrastructure owned and currently operated by government players, such as EGPC and EGAS. This will open the gas market for a competitive environment and help with the launching of the market liberalization strategy.

- The Gas Regulator can license one or more Transmission System Operator(s) (TSO) to operate the transmission grid and several local distribution companies (LDCs) to operate the distribution network. Shippers will contract with the TSO(s) to transmit their gas through the TSO’s grid to Suppliers. TSOs and Shippers will be bound by the Transmission Network Code (TNC) issued by the Gas Regulator regulating the specifications and conditions of transmission and the Transmission Tariff, also issued by the Gas Regulator to set prices.

- Shippers will typically sell/handover the gas to Suppliers who will contract with LDCs to use their distribution grids to reach consumers and export pipelines. Both Suppliers and LDCs will be bound by the Distribution Code and Distribution Tariff set by the Gas Regulator.

- Licensed operators of the gas storage facilities, LNG facilities, and regasification facilities shall also collect charges (a tariff set by the Gas Regulator) from the Shipper in consideration of their services.

- It is worth mentioning that the Draft Gas Law is not very clear as to how discrimination in access to transmission and distribution grids will be prevented or how competition between the parties will be protected. The Draft Law states that this will be further clarified in the executive regulation (ER) or the TNC.

Eligible and Non-Eligible Consumers:

- Similar to the new electricity regime, the Draft Gas Law differentiates between Eligible Consumers and Non-Eligible Consumers. Only Eligible Consumers will have the freedom to enter into gas supply agreements with suppliers of their choice and with freely negotiated price and gas quantities. This will take place through a competitive market set-up that will be established after the law enters into force. The Draft Gas Law provides that Eligible consumers may switch from one supplier to another; however, it does not provide any conditions on limitations on how this works. We anticipate this will be addressed in the ER or the rules governing the competitive market.

- Non-Eligible Consumers may not choose their gas suppliers and shall pay the fixed price set by the government for the amount of gas supplied to them.

Licensing Regime:

- Any entity shall obtain a license from the Gas Regulator before engaging in any of the Gas Market Activities. The duration of the license shall be determined in the ER (expected to be for a term of 5 years renewable, according to the draft Shipper’s/Supplier’s licenses being discussed).

- Each activity referred to above requires a different license. The two activities of shipping and supply may be carried jointly by one entity after being licensed by the Gas Regulator to do both.

- The Draft Gas Law allows a “Multi-Activity Entity” to combine different service activities (transfer, distribution, storage, liquefaction and regasification) with market activities namely shipping or supply, provided that it establishes a separate legal vehicle with independent organizational structures for each type of activity. There is some confusion in the drafting of Article 44 regulating the obligations of Multi-Activity Entities, which we hope will be clarified before the Draft Gas Law is issued. The Draft Gas Law gives a five-year grace period to existing bodies to abide by the rules on separation of activities.

- For an entity to receive a license in any of the Gas Market Activities, it has to:

- Pay a fee (maximum of USD 0.1 per cubic meter, paid in EGP).

- Pay an insurance to prove seriousness (the amount of the insurance shall be determined in the ER).

- Provide documents to prove technical and financial capability.

- Any licensed entity will need to obtain the Gas Regulator’s approval to:

- Assign its license to another entity.

- Sub-contract any entity to perform the license activity on its behalf.

- Conduct any change to the title of its shares whether through sale, purchase or transfer of shares, capital or assets.

- Take any action that would result in a change of control in relation to the capital of the licensed entity.

What Happens To EGAS And EGPC?

- EGAS and EGPC are currently the only entities involved in the gas transmission (shipping). Therefore, after the Draft Gas Law enters into force, the old dynamics will certainly change, since there other parties will become involved. EGAS and EGPC will continue to ship gas along with other licensed parties. EGAS and EGPC will contract with TSOs and be committed to the obligations regarding the supplying, shipping and using the grids. EGAS and EGPC will also be bound by the tariff determined by the Gas Regulator and shall preserve transparency. (see here)

New Draft Law On Gas Market Downstream & Midstream Activities

23rd of January, 2017

Keywords: Oil & Gas and Mineral Resources

The draft gives private parties access to the gas infrastructure and provides details of a new licensing regime.

Despite the great gas discovery back in August 2015 (see here), the gas market still suffers; as Egypt’s gas production does not meet market needs (see here). As an attempt to overcome this inefficiency and reform the gas sector, the government chose to embark on a gradual gas market liberalization scheme, in conformity with international practice. After two years of working on a new gas transmission system with technical assistance from the EU, in December the government submitted to parliament its revised draft law regarding the regulation of the downstream and midstream sectors. The Draft Gas Market Activities Regulation Law (the “Draft Gas Law”) is another step by the government in the right direction for policy reform. The new regime will hopefully improve the investment environment both in the oil & gas sector, as well as in industrial and export sectors reliant on gas.

The Draft Gas Law does not address the gas upstream sector or oil concession agreements. The legal framework of upstream activities is still intact. The Draft Gas Law regulates transmission, distribution, storage, liquefaction, regasification, shipping and supply of gas (the “Gas Market Activities”). The Draft Gas Law is an attempt to gradually liberalize the gas market. It allows the private sector for the first time to engage in Gas Market Activities.

agreements. The legal framework of upstream activities is still intact. The Draft Gas Law regulates transmission, distribution, storage, liquefaction, regasification, shipping and supply of gas (the “Gas Market Activities”). The Draft Gas Law is an attempt to gradually liberalize the gas market. It allows the private sector for the first time to engage in Gas Market Activities.

The Draft Gas Law Establishes A New Gas Market Regulator:

- The Draft Gas Law establishes the Authority for Regulating the Activities of the Gas Market (the “Gas Regulator”). The Gas Regulator shall be an independent public entity affiliated to the Ministry of Petroleum. The Gas Regulator’s main objective will be regulating and controlling the gas market downstream and midstream activities; securing the supply of gas to meet domestic market needs; and setting a plan to attract and encourage gas market investments.

- The Gas Regulator will be responsible for:

- Granting licenses to gas market parties.

- Ensuring competitiveness and transparency between the gas market parties.

- Setting tariff methodologies for the use of gas transfer/distribution grids.

- Settling the disputes that may arise between the parties involved in gas market activities.

The Market Structure After The New Regime

Third Party Access:

- The new law introduces to the Egyptian gas market “Third Party Access (TPA)” policies. According to TPA, and for the first time, the private sector will have access to the gas transmission and distribution infrastructure owned and currently operated by government players, such as EGPC and EGAS. This will open the gas market for a competitive environment and help with the launching of the market liberalization strategy.

- The Gas Regulator can license one or more Transmission System Operator(s) (TSO) to operate the transmission grid and several local distribution companies (LDCs) to operate the distribution network. Shippers will contract with the TSO(s) to transmit their gas through the TSO’s grid to Suppliers. TSOs and Shippers will be bound by the Transmission Network Code (TNC) issued by the Gas Regulator regulating the specifications and conditions of transmission and the Transmission Tariff, also issued by the Gas Regulator to set prices.

- Shippers will typically sell/handover the gas to Suppliers who will contract with LDCs to use their distribution grids to reach consumers and export pipelines. Both Suppliers and LDCs will be bound by the Distribution Code and Distribution Tariff set by the Gas Regulator.

- Licensed operators of the gas storage facilities, LNG facilities, and regasification facilities shall also collect charges (a tariff set by the Gas Regulator) from the Shipper in consideration of their services.

- It is worth mentioning that the Draft Gas Law is not very clear as to how discrimination in access to transmission and distribution grids will be prevented or how competition between the parties will be protected. The Draft Law states that this will be further clarified in the executive regulation (ER) or the TNC.

Eligible and Non-Eligible Consumers:

- Similar to the new electricity regime, the Draft Gas Law differentiates between Eligible Consumers and Non-Eligible Consumers. Only Eligible Consumers will have the freedom to enter into gas supply agreements with suppliers of their choice and with freely negotiated price and gas quantities. This will take place through a competitive market set-up that will be established after the law enters into force. The Draft Gas Law provides that Eligible consumers may switch from one supplier to another; however, it does not provide any conditions on limitations on how this works. We anticipate this will be addressed in the ER or the rules governing the competitive market.

- Non-Eligible Consumers may not choose their gas suppliers and shall pay the fixed price set by the government for the amount of gas supplied to them.

Licensing Regime:

- Any entity shall obtain a license from the Gas Regulator before engaging in any of the Gas Market Activities. The duration of the license shall be determined in the ER (expected to be for a term of 5 years renewable, according to the draft Shipper’s/Supplier’s licenses being discussed).

- Each activity referred to above requires a different license. The two activities of shipping and supply may be carried jointly by one entity after being licensed by the Gas Regulator to do both.

- The Draft Gas Law allows a “Multi-Activity Entity” to combine different service activities (transfer, distribution, storage, liquefaction and regasification) with market activities namely shipping or supply, provided that it establishes a separate legal vehicle with independent organizational structures for each type of activity. There is some confusion in the drafting of Article 44 regulating the obligations of Multi-Activity Entities, which we hope will be clarified before the Draft Gas Law is issued. The Draft Gas Law gives a five-year grace period to existing bodies to abide by the rules on separation of activities.

- For an entity to receive a license in any of the Gas Market Activities, it has to:

- Pay a fee (maximum of USD 0.1 per cubic meter, paid in EGP).

- Pay an insurance to prove seriousness (the amount of the insurance shall be determined in the ER).

- Provide documents to prove technical and financial capability.

- Any licensed entity will need to obtain the Gas Regulator’s approval to:

- Assign its license to another entity.

- Sub-contract any entity to perform the license activity on its behalf.

- Conduct any change to the title of its shares whether through sale, purchase or transfer of shares, capital or assets.

- Take any action that would result in a change of control in relation to the capital of the licensed entity.

What Happens To EGAS And EGPC?

- EGAS and EGPC are currently the only entities involved in the gas transmission (shipping). Therefore, after the Draft Gas Law enters into force, the old dynamics will certainly change, since there other parties will become involved. EGAS and EGPC will continue to ship gas along with other licensed parties. EGAS and EGPC will contract with TSOs and be committed to the obligations regarding the supplying, shipping and using the grids. EGAS and EGPC will also be bound by the tariff determined by the Gas Regulator and shall preserve transparency. (see here)

The Draft Gas Law does not address the gas upstream sector or oil concession agreements. The legal framework of upstream activities is still intact. The Draft Gas Law regulates transmission, distribution, storage, liquefaction, regasification, shipping and supply of gas (the “Gas Market Activities”). The Draft Gas Law is an attempt to gradually liberalize the gas market. It allows the private sector for the first time to engage in Gas Market Activities.

agreements. The legal framework of upstream activities is still intact. The Draft Gas Law regulates transmission, distribution, storage, liquefaction, regasification, shipping and supply of gas (the “Gas Market Activities”). The Draft Gas Law is an attempt to gradually liberalize the gas market. It allows the private sector for the first time to engage in Gas Market Activities.

The Draft Gas Law Establishes A New Gas Market Regulator:

- The Draft Gas Law establishes the Authority for Regulating the Activities of the Gas Market (the “Gas Regulator”). The Gas Regulator shall be an independent public entity affiliated to the Ministry of Petroleum. The Gas Regulator’s main objective will be regulating and controlling the gas market downstream and midstream activities; securing the supply of gas to meet domestic market needs; and setting a plan to attract and encourage gas market investments.

- The Gas Regulator will be responsible for:

- Granting licenses to gas market parties.

- Ensuring competitiveness and transparency between the gas market parties.

- Setting tariff methodologies for the use of gas transfer/distribution grids.

- Settling the disputes that may arise between the parties involved in gas market activities.

The Market Structure After The New Regime

Third Party Access:

- The new law introduces to the Egyptian gas market “Third Party Access (TPA)” policies. According to TPA, and for the first time, the private sector will have access to the gas transmission and distribution infrastructure owned and currently operated by government players, such as EGPC and EGAS. This will open the gas market for a competitive environment and help with the launching of the market liberalization strategy.

- The Gas Regulator can license one or more Transmission System Operator(s) (TSO) to operate the transmission grid and several local distribution companies (LDCs) to operate the distribution network. Shippers will contract with the TSO(s) to transmit their gas through the TSO’s grid to Suppliers. TSOs and Shippers will be bound by the Transmission Network Code (TNC) issued by the Gas Regulator regulating the specifications and conditions of transmission and the Transmission Tariff, also issued by the Gas Regulator to set prices.

- Shippers will typically sell/handover the gas to Suppliers who will contract with LDCs to use their distribution grids to reach consumers and export pipelines. Both Suppliers and LDCs will be bound by the Distribution Code and Distribution Tariff set by the Gas Regulator.

- Licensed operators of the gas storage facilities, LNG facilities, and regasification facilities shall also collect charges (a tariff set by the Gas Regulator) from the Shipper in consideration of their services.

- It is worth mentioning that the Draft Gas Law is not very clear as to how discrimination in access to transmission and distribution grids will be prevented or how competition between the parties will be protected. The Draft Law states that this will be further clarified in the executive regulation (ER) or the TNC.

Eligible and Non-Eligible Consumers:

- Similar to the new electricity regime, the Draft Gas Law differentiates between Eligible Consumers and Non-Eligible Consumers. Only Eligible Consumers will have the freedom to enter into gas supply agreements with suppliers of their choice and with freely negotiated price and gas quantities. This will take place through a competitive market set-up that will be established after the law enters into force. The Draft Gas Law provides that Eligible consumers may switch from one supplier to another; however, it does not provide any conditions on limitations on how this works. We anticipate this will be addressed in the ER or the rules governing the competitive market.

- Non-Eligible Consumers may not choose their gas suppliers and shall pay the fixed price set by the government for the amount of gas supplied to them.

Licensing Regime:

- Any entity shall obtain a license from the Gas Regulator before engaging in any of the Gas Market Activities. The duration of the license shall be determined in the ER (expected to be for a term of 5 years renewable, according to the draft Shipper’s/Supplier’s licenses being discussed).

- Each activity referred to above requires a different license. The two activities of shipping and supply may be carried jointly by one entity after being licensed by the Gas Regulator to do both.

- The Draft Gas Law allows a “Multi-Activity Entity” to combine different service activities (transfer, distribution, storage, liquefaction and regasification) with market activities namely shipping or supply, provided that it establishes a separate legal vehicle with independent organizational structures for each type of activity. There is some confusion in the drafting of Article 44 regulating the obligations of Multi-Activity Entities, which we hope will be clarified before the Draft Gas Law is issued. The Draft Gas Law gives a five-year grace period to existing bodies to abide by the rules on separation of activities.

- For an entity to receive a license in any of the Gas Market Activities, it has to:

- Pay a fee (maximum of USD 0.1 per cubic meter, paid in EGP).

- Pay an insurance to prove seriousness (the amount of the insurance shall be determined in the ER).

- Provide documents to prove technical and financial capability.

- Any licensed entity will need to obtain the Gas Regulator’s approval to:

- Assign its license to another entity.

- Sub-contract any entity to perform the license activity on its behalf.

- Conduct any change to the title of its shares whether through sale, purchase or transfer of shares, capital or assets.

- Take any action that would result in a change of control in relation to the capital of the licensed entity.

What Happens To EGAS And EGPC?

- EGAS and EGPC are currently the only entities involved in the gas transmission (shipping). Therefore, after the Draft Gas Law enters into force, the old dynamics will certainly change, since there other parties will become involved. EGAS and EGPC will continue to ship gas along with other licensed parties. EGAS and EGPC will contract with TSOs and be committed to the obligations regarding the supplying, shipping and using the grids. EGAS and EGPC will also be bound by the tariff determined by the Gas Regulator and shall preserve transparency. (see here)

Key Contacts

Insights

Disclaimer

The information included in this publication/client alert is not legal advice or any other advice. Publications and client alerts on this site are current as of their date of publication and do not necessarily reflect the present law or regulations. Please feel free to contact us should you need any legal advice related to the publication/client alert. Sharkawy & Sarhan (the “Firm”) will not be held liable for any compensatory, special, direct, incidental, indirect, or consequential damages, exemplary damages or any damages whatsoever arising out of or in connection with the use of the data, information or material included in this publication/client alert. This publication/client alert may contain links to third-party websites that are not controlled by the Firm. These third-party links are made available to you as a convenience and you agree to use these links at your own risk. Please be aware that the Firm is not responsible for the content or services offered by and of third-party websites, links as included in the Newsletter nor are we responsible for the privacy policy or practices of third-party websites links included therein.

Authorization of Use

The data, information, and material included in this publication/client alert are solely owned by the Firm. All rights related are reserved under the laws of the Arab Republic of Egypt. No part of this publication/client alert can be redistributed, copied, or reproduced without the prior written consent of the Firm.