Mergers & Acquisitions

In-depth knowledge of the M&A sector, its mechanics, challenges, and different complex structures

Mergers & Acquisitions

In-depth knowledge of the M&A sector, its mechanics, challenges, and different complex structures

Our deep on-the-ground knowledge of substantive legal matters, our local market expertise and our appreciation of industry specific issues allow us to navigate the Egyptian legal framework with confidence.

We dedicate a specialised team to our M&A transactions. We have extensive experience in all aspects of M&A legal work from corporate mergers, acquisitions, joint ventures as well as debt and equity financings.

Our deep on-the-ground knowledge of substantive legal matters, our local market expertise and our appreciation of industry specific issues allow us to navigate the Egyptian legal framework with confidence.

The team at Sharkawy & Sarhan has led the market on most big-ticket M&A transactions in Egypt. This experience has enabled us to develop focused expertise while maintaining our strong reputation for efficiency and high standards. We have a dedicated M&A team with in-depth knowledge of the M&A sector, its mechanics, challenges, and different complex structures. This knowledge together with our strong negotiation skills and reasonable commercial attitude are key tools in closing transactions on time and successfully.

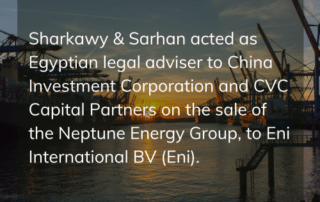

Featured Deals

Retail & Consumer Goods

Allianz SE, one of the world’s leading insurers and asset managers, on the Egyptian law aspects and restructuring of its agreement with Sanlam, the largest non-banking financial services company in Africa, to combine their current and future operations across Africa (including 31 jurisdictions and excluding South Africa), which would create the largest Pan-African non-banking financial services entity on the continent.

Financial Institutions

Softline Group LTD on the acquisition of 49% of Digitech for Information Technology SAE, including the drafting of transaction documents and advising on the transfer of shares process before the EGX.

Financial Institutions

Société Générale on the sale of its stake in National Société Générale Bank to Qatar National Bank Group, the largest financial institution in the MENA region, for a consideration of EUR1.5bn. The transaction was the largest bank M&A transaction in the MENA region after the financial crisis.

Technology, Media & Telecommunication

Vodafone Group Plc (Vodafone) in relation to the transfer of its 55% shareholding in Vodafone Egypt for Telecommunications S.A.E to Vodacom Group Limited (VGL).

EFG Hermes Private Equity on the sale of 100% stake in Ridgewood Group, leading water desalination and treatment group companies, to a joint venture between Hassan Allam Utilities and Almar Water Solutions. Our work included leading on the drafting and negotiation of the Egyptian law Transaction Documents.

Financial Institutions

BNP Paribas on the sale of its entire stake in its Egyptian Bank BNP Paribas S.A.E. to Emirates NBD.

Infrastructure . Healthcare

Meden Healthcare, part of the Saham Sante Group, on all aspects of the sale of its indirect stake in Hassab Labs Egypt, one of the fast-growing diagnostics laboratory chains in Egypt to Al Tayseer International Hospital.

Featured Deals

Healthcare

Allianz SE, one of the world’s leading insurers and asset managers, on the Egyptian law aspects and restructuring of its agreement with Sanlam, the largest non-banking financial services company in Africa, to combine their current and future operations across Africa (including 31 jurisdictions and excluding South Africa), which would create the largest Pan-African non-banking financial services entity on the continent.

Financial Institutions

Attijariwafa Bank on the acquisition of of Barclays Egypt, a global financial services group present in 18 Egyptian cities with 56 branches. This transaction represents a first of this scale from a Moroccan financial operator on the Egyptian market.

Technology, Media & Telecommunication

Vodafone Group Plc (Vodafone) in relation to the transfer of its 55% shareholding in Vodafone Egypt for Telecommunications S.A.E to Vodacom Group Limited (VGL).

Financial Institutions

Société Générale on the sale of its stake in National Société Générale Bank to Qatar National Bank Group, the largest financial institution in the MENA region, for a consideration of EUR1.5bn. The transaction was the largest bank M&A transaction in the MENA region after the financial crisis.

Technology, Media & Telecommunication

Softline Group LTD on the acquisition of 49% of Digitech for Information Technology SAE, including the drafting of transaction documents and advising on the transfer of shares process before the EGX.

Healthcare

Meden Healthcare, part of the Saham Sante Group, on all aspects of the sale of its stake in Hassab Labs Egypt, one of the fast-growing diagnostics laboratory chains in Egypt to Al Tayseer International Hospital.

EFG Hermes Private Equity on the sale of its stake in Ridgewood Group, leading water desalination and treatment group companies, to a joint venture between Hassan Allam Utilities and Almar Water Solutions. Our work included leading on the drafting and negotiation of the Egyptian law Transaction Documents.

Infrastructure

General Electric on a number of their acquisitions including General Electric’s global acquisition of Alstom SA‘s power business and acquisition of the well support division of Wood Group.

Retail & Consumer Goods . Healthcare

Nestlé on a number of their M&As including Nestle’s acquisition of Pfizer Nutrition business, Nestle’s sale of its chilled dairy business in Egypt to Best Cheese Company as part of Nestlé’s worldwide joint venture with Lactalis and Nestle’s acquisition of Bonjorno, a local leading Egyptian company in the instant coffee business.

Insights

Insights

They are very responsive, reliable and diligent. They understand the client’s commercial intention and is able to negotiate with the seller on local law-specific points and they are able to draft due diligence reports in very sophisticated way. Overall they have delivered a very high-level quality service, exceeding our expectation of a ‘local counsel’.

Very responsive and technically very strong. They work well on cross-border transactions – many of their lawyers have international experience.