17th of January, 2017

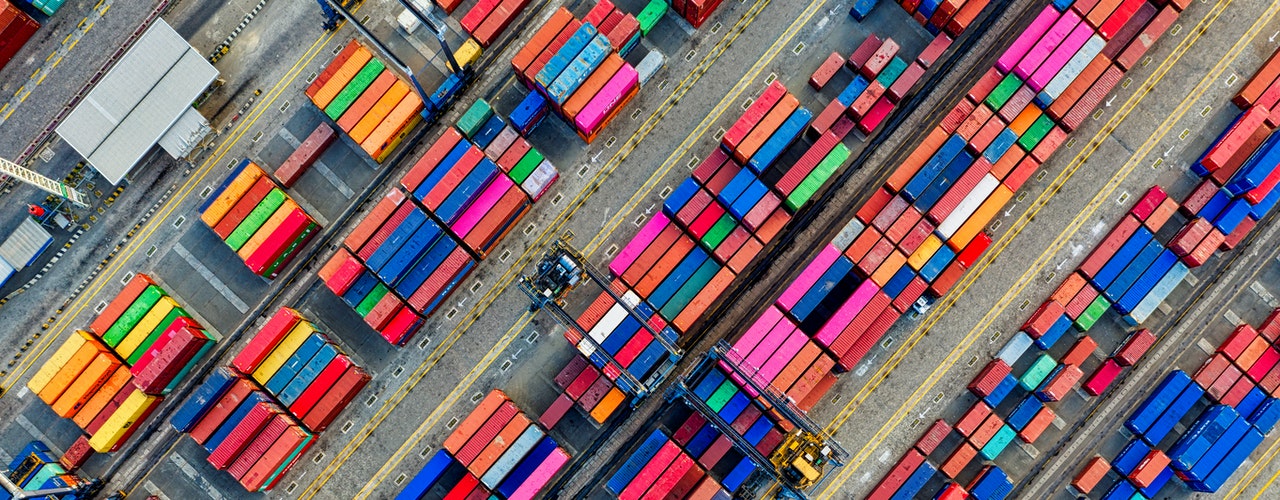

New Regulations for Importation: Are They Good For Egypt?

By: Lamiaa Youssef

Keywords: Retail & Consumer Goods, Commercial

New Regulations for Importation: Are They Good For Egypt?

Registration Is Mandatory (And Somewhat Difficult for Some), Banks Are in the Loop & Supervision Is Tight

In its efforts to restore financial stability and confirm the market’s efficiency, the government issued several new decisions and regulations restricting importation.

The new policy aims to lift the pressure off the national currency and to ensure the quality of the imports. The decisions will prevent counterfeited products from entering the country, since an endorsement from the owner of the trademark is necessary for the release of goods. However, the decisions may also result in the exclusion of small businesses, as they require the producer to have legal form and licensing in its home country as well as certified quality control systems. The decisions make access to foreign currency difficult and are likely to lead to an increase in prices.

In all events, importers need to undergo lengthy procedures to register; they will need to change the way they do business, particularly in relation to reporting the real price and to the payment terms and conditions. It is unlikely they will be able to do so speedily enough to meet the date of application of the new decisions. In addition, access to foreign currency will be made very difficult except to importers of basic commodities and manufacturing needs.

Importers have received these decisions poorly, claiming that they will lead to monopolistic positions in the market and increase in prices (This is the side of the coin perceived by opponents). Officials argue that it is better for the consumer and the economy, as it will improve the quality of imported products, decrease the pressure on foreign currency, and prevent “random” importation (This is the side of the coin perceived by proponents). It remains to be seen whether these measures will be good for the Egyptian economy.

Here is a summary of the major decisions and regulations introducing the new measures:

A) The Minister of Commerce & Industry’s Decision 43/2016 (attached in Arabic)

- The new decision amends the decision 992/2015 restricts the release of specific imports, mostly cosmetics, food, toys, textiles & furniture (for a full list, see the annex attached to the decision in Arabic). In order to release the goods, the foreign exporter must be registered in a specific register at the General Organization for Export & Import Control (GOEIC). The decision enters into force on 16 March 2016. In order to be registered, the decision requires a lengthy process and several documents, which differs depending on whether the exporter is a factory manufacturing under a license or a trademark owner. For example, the documents include the trademark registration, operational licenses, and a certificate proving the existence of quality control measures from approved entities. For more details on the required documents, press here.

B) The Customs Authority’s Circulation 202/2015 (attached in Arabic),

- Essentially, the circulation activates the (so far dormant) legal provisions requiring the importer to submit a legalized invoice and submit the purchase agreements/bills, along with all relevant documentations in order to release the goods (Articles 23 & 30 of the Customs Law 66/1963). Accordingly, the invoice needs to be legalized with the Egyptian Consulate in the exporter’s country, then with the Ministry of Foreign Affairs in Egypt. This adds an additional layer of procedures and costs to the importation process, and will likely lead to an increase in prices. The circular aims to combat the wide practice of submitting fake invoices with reduced prices, in order to decrease the customs duty.

C) CBE Circular dated 21 December 2015 (attached in Arabic), as amended:

- The circular, issued by Tarek Amer, the Head of the Central Bank of Egypt (CBE), ties banks with customs in the process.

- The circular mandates that, effective from 21 Jan 2016, the documentary collection process for payment of goods should go through foreign banks and not through the clients/creditors. The circular imposes on foreign banks to pass the payment documents directly to the Egyptian bank. Branches and Affiliates of foreign companies, as well as importers of manufacturing needs and spare parts shipped by air, were later excluded from this requirement via CBE circular dated 27 January 2016 (attached in Arabic).

- The circular also increases the value of cash deposits to be paid by the client in order to open a letter of credit from 50% of the value of the L/C to 100%. Some industries are excluded, such as pharmaceuticals and baby formula. Per the decision, this is applied starting 1 January 2016. As per the amendment dated 27 January 2016, clients may provide such cash deposits in EGP, adding an appropriate mark-up for currency fluctuation. In addition, importation of spare parts and equipment as well as IT related goods (software and hardware) are now also excluded from this requirement as well.

- Clients (other than those importing capital equipment, manufacturing needs and raw materials) may not use their permitted Egyptian pounds credit limit to finance such L/Cs or to trade in currency for their importation needs.•

- In addition, the circular suspends the banks’ powers to refinance clients with their foreign currency needs for importation (previously permitted by CBE circular 14 January 2013, attached in Arabic). Accordingly, only clients/importers who have their own foreign currency reserves will be able to import. The 27 January 2016 amendment now permits specific industries to receive foreign currency financing. The importer can take foreign currency financing from the bank, if he is importing medical equipment, spare parts or IT goods. In addition, if the client is importing raw materials for manufacturing, he may receive foreign currency financing, if he is an industrial institution, if he submits an existing contract with the exporter and subject to a case-by-case approval.

- What does this mean? Let’s break it down (Press here for an info-graph of the CBE’s amendments).

D) The president has issued the decision 25/2016 (attached in Arabic), which amends the decision 184/2013, to raise the tariffs of many consumer and luxurious goods

- The new decision aims to increase the barrier against the importation of the consumer and luxurious goods that are not used for industrial purposes in Egypt. Mostly, a 10% increase has been added to the tariffs paid on these goods compared to their tariff under the decision 184/2013. Most of the goods listed under the decision 43/2016 are covered under this presidential decision.

Time will tell if these measures will improve the foreign currency crunch or complicate it. We would be interested to receive your perspectives or real-time experiences with these new measures.

The new policy aims to lift the pressure off the national currency and to ensure the quality of the imports. The decisions will prevent counterfeited products from entering the country, since an endorsement from the owner of the trademark is necessary for the release of goods. However, the decisions may also result in the exclusion of small businesses, as they require the producer to have legal form and licensing in its home country as well as certified quality control systems. The decisions make access to foreign currency difficult and are likely to lead to an increase in prices.

In all events, importers need to undergo lengthy procedures to register; they will need to change the way they do business, particularly in relation to reporting the real price and to the payment terms and conditions. It is unlikely they will be able to do so speedily enough to meet the date of application of the new decisions. In addition, access to foreign currency will be made very difficult except to importers of basic commodities and manufacturing needs.

Importers have received these decisions poorly, claiming that they will lead to monopolistic positions in the market and increase in prices (This is the side of the coin perceived by opponents). Officials argue that it is better for the consumer and the economy, as it will improve the quality of imported products, decrease the pressure on foreign currency, and prevent “random” importation (This is the side of the coin perceived by proponents). It remains to be seen whether these measures will be good for the Egyptian economy.

Here is a summary of the major decisions and regulations introducing the new measures:

A) The Minister of Commerce & Industry’s Decision 43/2016 (attached in Arabic)

- The new decision amends the decision 992/2015 restricts the release of specific imports, mostly cosmetics, food, toys, textiles & furniture (for a full list, see the annex attached to the decision in Arabic). In order to release the goods, the foreign exporter must be registered in a specific register at the General Organization for Export & Import Control (GOEIC). The decision enters into force on 16 March 2016. In order to be registered, the decision requires a lengthy process and several documents, which differs depending on whether the exporter is a factory manufacturing under a license or a trademark owner. For example, the documents include the trademark registration, operational licenses, and a certificate proving the existence of quality control measures from approved entities. For more details on the required documents, press here.

B) The Customs Authority’s Circulation 202/2015 (attached in Arabic),

- Essentially, the circulation activates the (so far dormant) legal provisions requiring the importer to submit a legalized invoice and submit the purchase agreements/bills, along with all relevant documentations in order to release the goods (Articles 23 & 30 of the Customs Law 66/1963). Accordingly, the invoice needs to be legalized with the Egyptian Consulate in the exporter’s country, then with the Ministry of Foreign Affairs in Egypt. This adds an additional layer of procedures and costs to the importation process, and will likely lead to an increase in prices. The circular aims to combat the wide practice of submitting fake invoices with reduced prices, in order to decrease the customs duty.

C) CBE Circular dated 21 December 2015 (attached in Arabic), as amended:

- The circular, issued by Tarek Amer, the Head of the Central Bank of Egypt (CBE), ties banks with customs in the process.

- The circular mandates that, effective from 21 Jan 2016, the documentary collection process for payment of goods should go through foreign banks and not through the clients/creditors. The circular imposes on foreign banks to pass the payment documents directly to the Egyptian bank. Branches and Affiliates of foreign companies, as well as importers of manufacturing needs and spare parts shipped by air, were later excluded from this requirement via CBE circular dated 27 January 2016 (attached in Arabic).

- The circular also increases the value of cash deposits to be paid by the client in order to open a letter of credit from 50% of the value of the L/C to 100%. Some industries are excluded, such as pharmaceuticals and baby formula. Per the decision, this is applied starting 1 January 2016. As per the amendment dated 27 January 2016, clients may provide such cash deposits in EGP, adding an appropriate mark-up for currency fluctuation. In addition, importation of spare parts and equipment as well as IT related goods (software and hardware) are now also excluded from this requirement as well.

- Clients (other than those importing capital equipment, manufacturing needs and raw materials) may not use their permitted Egyptian pounds credit limit to finance such L/Cs or to trade in currency for their importation needs.•

- In addition, the circular suspends the banks’ powers to refinance clients with their foreign currency needs for importation (previously permitted by CBE circular 14 January 2013, attached in Arabic). Accordingly, only clients/importers who have their own foreign currency reserves will be able to import. The 27 January 2016 amendment now permits specific industries to receive foreign currency financing. The importer can take foreign currency financing from the bank, if he is importing medical equipment, spare parts or IT goods. In addition, if the client is importing raw materials for manufacturing, he may receive foreign currency financing, if he is an industrial institution, if he submits an existing contract with the exporter and subject to a case-by-case approval.

- What does this mean? Let’s break it down (Press here for an info-graph of the CBE’s amendments).

D) The president has issued the decision 25/2016 (attached in Arabic), which amends the decision 184/2013, to raise the tariffs of many consumer and luxurious goods

- The new decision aims to increase the barrier against the importation of the consumer and luxurious goods that are not used for industrial purposes in Egypt. Mostly, a 10% increase has been added to the tariffs paid on these goods compared to their tariff under the decision 184/2013. Most of the goods listed under the decision 43/2016 are covered under this presidential decision.

Time will tell if these measures will improve the foreign currency crunch or complicate it. We would be interested to receive your perspectives or real-time experiences with these new measures.

New Regulations for Importation: Are They Good For Egypt?

17th of January, 2017

By: Lamiaa Youssef

Keywords: Retail & Consumer Goods, Commercial

New Regulations for Importation: Are They Good For Egypt?

Registration Is Mandatory (And Somewhat Difficult for Some), Banks Are in the Loop & Supervision Is Tight

In its efforts to restore financial stability and confirm the market’s efficiency, the government issued several new decisions and regulations restricting importation.

The new policy aims to lift the pressure off the national currency and to ensure the quality of the imports. The decisions will prevent counterfeited products from entering the country, since an endorsement from the owner of the trademark is necessary for the release of goods. However, the decisions may also result in the exclusion of small businesses, as they require the producer to have legal form and licensing in its home country as well as certified quality control systems. The decisions make access to foreign currency difficult and are likely to lead to an increase in prices.

In all events, importers need to undergo lengthy procedures to register; they will need to change the way they do business, particularly in relation to reporting the real price and to the payment terms and conditions. It is unlikely they will be able to do so speedily enough to meet the date of application of the new decisions. In addition, access to foreign currency will be made very difficult except to importers of basic commodities and manufacturing needs.

Importers have received these decisions poorly, claiming that they will lead to monopolistic positions in the market and increase in prices (This is the side of the coin perceived by opponents). Officials argue that it is better for the consumer and the economy, as it will improve the quality of imported products, decrease the pressure on foreign currency, and prevent “random” importation (This is the side of the coin perceived by proponents). It remains to be seen whether these measures will be good for the Egyptian economy.

Here is a summary of the major decisions and regulations introducing the new measures:

A) The Minister of Commerce & Industry’s Decision 43/2016 (attached in Arabic)

- The new decision amends the decision 992/2015 restricts the release of specific imports, mostly cosmetics, food, toys, textiles & furniture (for a full list, see the annex attached to the decision in Arabic). In order to release the goods, the foreign exporter must be registered in a specific register at the General Organization for Export & Import Control (GOEIC). The decision enters into force on 16 March 2016. In order to be registered, the decision requires a lengthy process and several documents, which differs depending on whether the exporter is a factory manufacturing under a license or a trademark owner. For example, the documents include the trademark registration, operational licenses, and a certificate proving the existence of quality control measures from approved entities. For more details on the required documents, press here.

B) The Customs Authority’s Circulation 202/2015 (attached in Arabic),

- Essentially, the circulation activates the (so far dormant) legal provisions requiring the importer to submit a legalized invoice and submit the purchase agreements/bills, along with all relevant documentations in order to release the goods (Articles 23 & 30 of the Customs Law 66/1963). Accordingly, the invoice needs to be legalized with the Egyptian Consulate in the exporter’s country, then with the Ministry of Foreign Affairs in Egypt. This adds an additional layer of procedures and costs to the importation process, and will likely lead to an increase in prices. The circular aims to combat the wide practice of submitting fake invoices with reduced prices, in order to decrease the customs duty.

C) CBE Circular dated 21 December 2015 (attached in Arabic), as amended:

- The circular, issued by Tarek Amer, the Head of the Central Bank of Egypt (CBE), ties banks with customs in the process.

- The circular mandates that, effective from 21 Jan 2016, the documentary collection process for payment of goods should go through foreign banks and not through the clients/creditors. The circular imposes on foreign banks to pass the payment documents directly to the Egyptian bank. Branches and Affiliates of foreign companies, as well as importers of manufacturing needs and spare parts shipped by air, were later excluded from this requirement via CBE circular dated 27 January 2016 (attached in Arabic).

- The circular also increases the value of cash deposits to be paid by the client in order to open a letter of credit from 50% of the value of the L/C to 100%. Some industries are excluded, such as pharmaceuticals and baby formula. Per the decision, this is applied starting 1 January 2016. As per the amendment dated 27 January 2016, clients may provide such cash deposits in EGP, adding an appropriate mark-up for currency fluctuation. In addition, importation of spare parts and equipment as well as IT related goods (software and hardware) are now also excluded from this requirement as well.

- Clients (other than those importing capital equipment, manufacturing needs and raw materials) may not use their permitted Egyptian pounds credit limit to finance such L/Cs or to trade in currency for their importation needs.•

- In addition, the circular suspends the banks’ powers to refinance clients with their foreign currency needs for importation (previously permitted by CBE circular 14 January 2013, attached in Arabic). Accordingly, only clients/importers who have their own foreign currency reserves will be able to import. The 27 January 2016 amendment now permits specific industries to receive foreign currency financing. The importer can take foreign currency financing from the bank, if he is importing medical equipment, spare parts or IT goods. In addition, if the client is importing raw materials for manufacturing, he may receive foreign currency financing, if he is an industrial institution, if he submits an existing contract with the exporter and subject to a case-by-case approval.

- What does this mean? Let’s break it down (Press here for an info-graph of the CBE’s amendments).

D) The president has issued the decision 25/2016 (attached in Arabic), which amends the decision 184/2013, to raise the tariffs of many consumer and luxurious goods

- The new decision aims to increase the barrier against the importation of the consumer and luxurious goods that are not used for industrial purposes in Egypt. Mostly, a 10% increase has been added to the tariffs paid on these goods compared to their tariff under the decision 184/2013. Most of the goods listed under the decision 43/2016 are covered under this presidential decision.

Time will tell if these measures will improve the foreign currency crunch or complicate it. We would be interested to receive your perspectives or real-time experiences with these new measures.

The new policy aims to lift the pressure off the national currency and to ensure the quality of the imports. The decisions will prevent counterfeited products from entering the country, since an endorsement from the owner of the trademark is necessary for the release of goods. However, the decisions may also result in the exclusion of small businesses, as they require the producer to have legal form and licensing in its home country as well as certified quality control systems. The decisions make access to foreign currency difficult and are likely to lead to an increase in prices.

In all events, importers need to undergo lengthy procedures to register; they will need to change the way they do business, particularly in relation to reporting the real price and to the payment terms and conditions. It is unlikely they will be able to do so speedily enough to meet the date of application of the new decisions. In addition, access to foreign currency will be made very difficult except to importers of basic commodities and manufacturing needs.

Importers have received these decisions poorly, claiming that they will lead to monopolistic positions in the market and increase in prices (This is the side of the coin perceived by opponents). Officials argue that it is better for the consumer and the economy, as it will improve the quality of imported products, decrease the pressure on foreign currency, and prevent “random” importation (This is the side of the coin perceived by proponents). It remains to be seen whether these measures will be good for the Egyptian economy.

Here is a summary of the major decisions and regulations introducing the new measures:

A) The Minister of Commerce & Industry’s Decision 43/2016 (attached in Arabic)

- The new decision amends the decision 992/2015 restricts the release of specific imports, mostly cosmetics, food, toys, textiles & furniture (for a full list, see the annex attached to the decision in Arabic). In order to release the goods, the foreign exporter must be registered in a specific register at the General Organization for Export & Import Control (GOEIC). The decision enters into force on 16 March 2016. In order to be registered, the decision requires a lengthy process and several documents, which differs depending on whether the exporter is a factory manufacturing under a license or a trademark owner. For example, the documents include the trademark registration, operational licenses, and a certificate proving the existence of quality control measures from approved entities. For more details on the required documents, press here.

B) The Customs Authority’s Circulation 202/2015 (attached in Arabic),

- Essentially, the circulation activates the (so far dormant) legal provisions requiring the importer to submit a legalized invoice and submit the purchase agreements/bills, along with all relevant documentations in order to release the goods (Articles 23 & 30 of the Customs Law 66/1963). Accordingly, the invoice needs to be legalized with the Egyptian Consulate in the exporter’s country, then with the Ministry of Foreign Affairs in Egypt. This adds an additional layer of procedures and costs to the importation process, and will likely lead to an increase in prices. The circular aims to combat the wide practice of submitting fake invoices with reduced prices, in order to decrease the customs duty.

C) CBE Circular dated 21 December 2015 (attached in Arabic), as amended:

- The circular, issued by Tarek Amer, the Head of the Central Bank of Egypt (CBE), ties banks with customs in the process.

- The circular mandates that, effective from 21 Jan 2016, the documentary collection process for payment of goods should go through foreign banks and not through the clients/creditors. The circular imposes on foreign banks to pass the payment documents directly to the Egyptian bank. Branches and Affiliates of foreign companies, as well as importers of manufacturing needs and spare parts shipped by air, were later excluded from this requirement via CBE circular dated 27 January 2016 (attached in Arabic).

- The circular also increases the value of cash deposits to be paid by the client in order to open a letter of credit from 50% of the value of the L/C to 100%. Some industries are excluded, such as pharmaceuticals and baby formula. Per the decision, this is applied starting 1 January 2016. As per the amendment dated 27 January 2016, clients may provide such cash deposits in EGP, adding an appropriate mark-up for currency fluctuation. In addition, importation of spare parts and equipment as well as IT related goods (software and hardware) are now also excluded from this requirement as well.

- Clients (other than those importing capital equipment, manufacturing needs and raw materials) may not use their permitted Egyptian pounds credit limit to finance such L/Cs or to trade in currency for their importation needs.•

- In addition, the circular suspends the banks’ powers to refinance clients with their foreign currency needs for importation (previously permitted by CBE circular 14 January 2013, attached in Arabic). Accordingly, only clients/importers who have their own foreign currency reserves will be able to import. The 27 January 2016 amendment now permits specific industries to receive foreign currency financing. The importer can take foreign currency financing from the bank, if he is importing medical equipment, spare parts or IT goods. In addition, if the client is importing raw materials for manufacturing, he may receive foreign currency financing, if he is an industrial institution, if he submits an existing contract with the exporter and subject to a case-by-case approval.

- What does this mean? Let’s break it down (Press here for an info-graph of the CBE’s amendments).

D) The president has issued the decision 25/2016 (attached in Arabic), which amends the decision 184/2013, to raise the tariffs of many consumer and luxurious goods

- The new decision aims to increase the barrier against the importation of the consumer and luxurious goods that are not used for industrial purposes in Egypt. Mostly, a 10% increase has been added to the tariffs paid on these goods compared to their tariff under the decision 184/2013. Most of the goods listed under the decision 43/2016 are covered under this presidential decision.

Time will tell if these measures will improve the foreign currency crunch or complicate it. We would be interested to receive your perspectives or real-time experiences with these new measures.

Key Contacts

Insights

Disclaimer

The information included in this publication/client alert is not legal advice or any other advice. Publications and client alerts on this site are current as of their date of publication and do not necessarily reflect the present law or regulations. Please feel free to contact us should you need any legal advice related to the publication/client alert. Sharkawy & Sarhan (the “Firm”) will not be held liable for any compensatory, special, direct, incidental, indirect, or consequential damages, exemplary damages or any damages whatsoever arising out of or in connection with the use of the data, information or material included in this publication/client alert. This publication/client alert may contain links to third-party websites that are not controlled by the Firm. These third-party links are made available to you as a convenience and you agree to use these links at your own risk. Please be aware that the Firm is not responsible for the content or services offered by and of third-party websites, links as included in the Newsletter nor are we responsible for the privacy policy or practices of third-party websites links included therein.

Authorization of Use

The data, information, and material included in this publication/client alert are solely owned by the Firm. All rights related are reserved under the laws of the Arab Republic of Egypt. No part of this publication/client alert can be redistributed, copied, or reproduced without the prior written consent of the Firm.